President Obama signed the “Protecting Americans from Tax Hikes Act of 2015,” or the PATH Act, on December 18, 2015. It was the most notable tax legislation to be passed by Congress last year, and it will have a great effect on the upcoming tax season. It extended many expiring tax provisions, permanently in some cases, and it also addressed Earned Income Tax Credits and Child Tax Credits.

EITC Returns Will Not Be Released until February 15

Under the PATH Act, the IRS is required to hold all refunds for returns that claim EITC until February 15th. For those who file at the very beginning of the tax season, this means they may not see their refund for up to four weeks after filing. This allows the IRS additional time to help prevent revenue lost due to identity theft and refund fraud related to fabricated wages and withholdings.

Earned Income Tax Credit Changes

- Individuals cannot claim an EITC for a previous year via an amended return if the child did not have a social security number at the time of the original filing.

- If an individual falsely claims an EITC, the IRS can prevent him or her from claiming EITC again for up to 10 years.

Child Tax Credit Changes

The Child Tax Credit is a credit of $1,000 that can be claimed per family member who is under 17, living in the taxpayer’s home, claimed as a dependent, and does not account for more than half of his or her own income.

- Individuals cannot claim a CTC for a previous year via an amended return if the child did not have a social security number or ITIN at the time of the original filing.

- If an individual falsely claims a CTC, the IRS can prevent him or her from claiming CTC again for up to 2 years.

- Threshold for calculating additional child tax credit permanently reduced to $3,000.

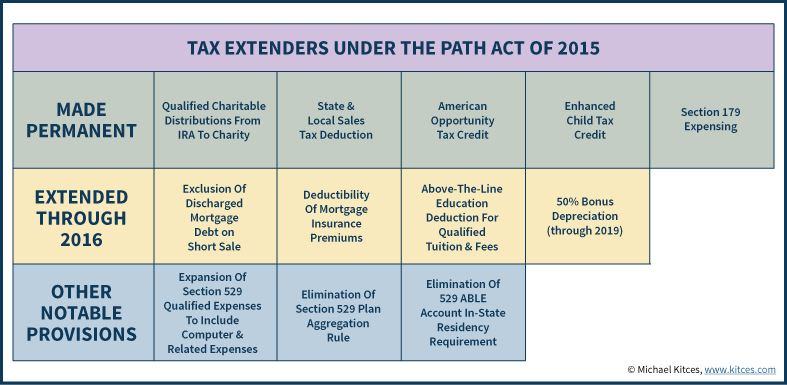

Other Tax Extenders under the PATH Act

(Image source from www.kitces.com)