Nice job! You’re enrolled in the Refund Transfer product offered by TaxAct® Professional.

Here are 3 things to check off right now to make sure you’re all set to offer this service with confidence throughout the tax season.

"After starting bank refund transfers and advances, my practice grew from 40 clients the first year, to 150 clients the next season. All because of the ease of use of TaxAct Professional and because I offered my clients bank products. Now they have the opportunity of not having to come up with the money to get their taxes done."

Felicia Ward, Marque, TX

When does bank enrollment end?

Republic Bank closes at the end of March and TPG is open year-round.

Can my clients use Bank Products for their state returns?

Yes, but only if they are also using it for their federal return and only one state. (This is only valid for PROs using TPG as their bank partner.)

Will using Bank Products cause delays in my clients receiving their refunds?

No. Refunds are e-filed and there is no additional delay.

How long after a client’s refund is received will I get my fees paid?

Banks typically disburse funds as soon as they are received from the IRS. Your fees are directly deposited into your bank account.

How and when are tax preparer incentives paid?

Eligible incentives are delivered in a single payment from participating banks after May 31 of the current tax year.

What are the bank product fees again?

Republic Bank – First Funding is $39.95 and Second Funding is $10.

TPG Santa Barbara – First Funding is $39.95 and Second Funding is $14.95.

What standard method of payment do the banks offer?

Both banks offer bank checks and direct deposit.

Does either bank offer alternative disbursement methods?

Yes, Republic Bank offers Net Spend Prepaid Visa Cards and Walmart Direct2Cash. TPG offers Walmart Direct2Cash, Walmart MoneyCard, and GO2Bank Visa Debit.

Is there a difference between the $15 transmittal fee and the $15 e-file fee?

Yes, the e-file fee is the cost to submit a return electronically through the TaxAct Professional Software. The transmittal fee is related directly to bank products and is the fee associated with transmission of a bank product between the bank and TaxAct Professional. Event those with unlimited e-files will be charged the $15 transmittal fee.

I am a first year bank products provider, do I qualify to offer Cash Advances to my client’s?

No, our bank partners require at least one year of history offering Refund Transfers before you can begin offering Cash Advance Products. There are additional requirements that must be met like bank volume and funding percentage. Contact one of our bank product experts today to learn more.

How do I take advantage of the Software Purchase Assistance Program?

Tax Professionals who have 40 or more funded bank products are able to apply to have their software costs paid upfront by a bank partner loan program. Once the tax season begins, the bank will deduct your tax software fees monthly until paid in full.

I don’t have clients who are low-income or don’t have a bank. Why should I consider offering my clients Pay-by-Refund?

Refund Transfer offer your clients, no matter their financial situation, the ability to have their tax prep fees deducted from their refund. It save having to pay upfront and they can collect their net refund when it is complete.

If my client chooses to use Pay-by-Refund, will it delay the refund?

No, using Pay-by-Refund does not delay the process of the return or the refund.

Lo Guerra, Bilingual Account Executive

(502) 588-1021

Margie Barito, Sales Manager

(502) 588-1591

Taxpayer Support

(866) 581-1040

Tax Pro Support (New to TPG)

(877) 901-5646

Tax Pro Support (Existing Client)

(800) 779-7228

Taxpayer Support

(800) 901-6663

Bank Product Offerings: Bank Products are offered by Republic Bank & Trust Company, Member FDIC and Santa Barbara Tax Products Group, LLC (TPG).

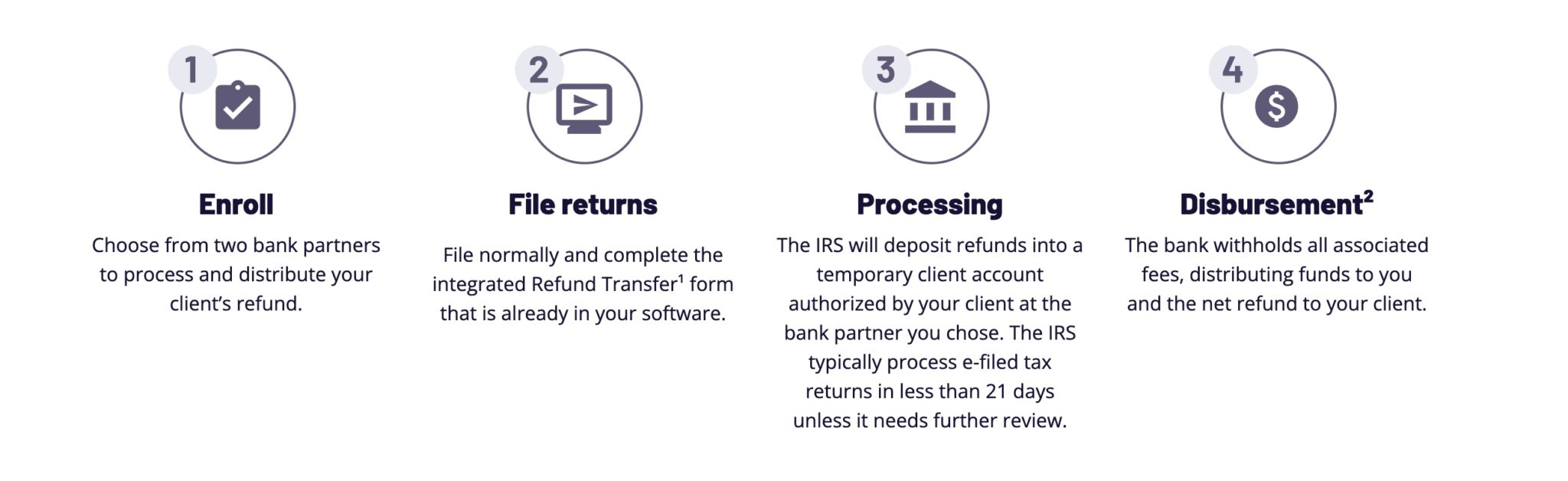

¹Refund Transfers are fee- based products offered by Republic Bank & Trust Company, Member FDIC and Santa Barbara Tax Products Group LLC (TPG) .

Refund Transfers offered by Republic Bank are fee-based products offered by Republic Bank & Trust Company, Member FDIC. A Refund Transfer Fee and all other authorized amounts will be deducted from the taxpayer’s tax refund.

Refund Transfers offered by TPG are deposit products using Civista Bank, Member FDIC, that enable certain deductions from the account to be processed. Refund Transfers are not loans. Tax refund and e-filing are required in order to receive Refund Transfer. Fees apply. Terms and conditions are subject to change without notice.

²If a customer chooses direct deposit, it may take additional time for their financial institution to post the funds to their account.

ERO must be enrolled for Republic Bank’s Refund Transfer Program to offer the Easy Advance programs. Cost to ERO per approved Easy Advance, if any, will be deducted from ERO tax preparation fees and cannot be passed to the taxpayer. If a customer does not choose a Refund Transfer, disbursement options are direct deposit or prepaid card. Net Refund refers to the taxpayer’s expected refund amount after deduction of all fees.

ERO must be enrolled for TPG’s Refund Transfer Program to offer the Fast Cash Advance program. Cost to ERO per approved Fast Cash Advance, if any, will be deducted from ERO tax preparation fees and cannot be passed to the taxpayer. If a customer does not choose a Refund Transfer, disbursement options are direct deposit or prepaid card. Net Refund refers to the taxpayer’s expected refund amount after deduction of all fees.

Software Purchase Assistance Program (SPA) is offered by Republic Bank & Trust, member FDIC. ERO must be eligible and approved by Republic Bank & Trust.

TaxAct, Inc. gets fees from some third parties, including Republic Bank and Santa Barbara Tax Products Group, LLC (TPG), that provide offers to its customers. This compensation may affect what and how we communicate Republic Bank or Santa Barbara Tax Products Group offers to you. TaxAct is not a party to any transactions you may choose to enter into with Republic Bank or Santa Barbara Tax Products Group, does not itself offer legal, financial, or investment advice, and disclaims any liability arising out of such transactions. Please see Republic Bank and Santa Barbara Tax Products Group’s websites for full terms and conditions.

TaxAct is not responsible for, and expressly disclaims all liability and damages, of any kind arising out of use, reference to, or reliance on any third party information contained on this site.

© 2024 TaxAct, Inc., a Taxwell company. All Rights Reserved