Overview on some of the new features in the tax preparation software

With tax season here, we wanted to remind you of time-saving features in the TaxAct Professional software. These features are built to make your job more efficient while putting your clients in the best possible financial situation.

- Ability to automatically lock returns after e-filing and lock returns for editing

- Set your preference to automatically lock returns after they’ve been submitted for e-file

- The preparer assigned to the return or a Practice Admin can unlock that return at any time to edit

- Can also manually lock/unlock returns from Client Manager through the right click menu. You can also select multiple returns to lock/unlock them at the same time.

- Improved login experience including password recovery (available by end of January 2018)

- Year-over-year side-by-side comparison of forms/schedules

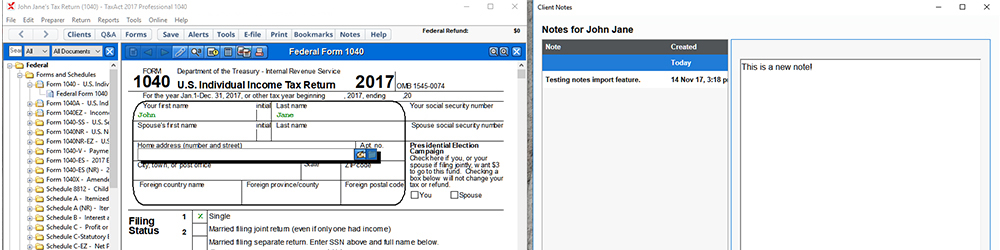

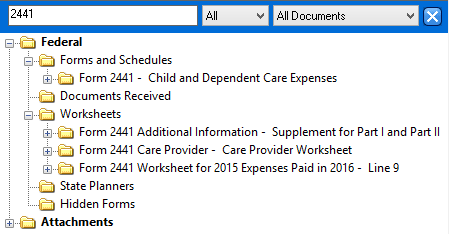

- “Search” field added in forms view to quickly filter by keywords and/or numbers

- Zip code lookup automatically populates City, State, and County throughout the return in forms view, interview, quick entry and Practice/Preparer info

- Fields added to Client Information including retirement date, driver’s license number, additional email address and more

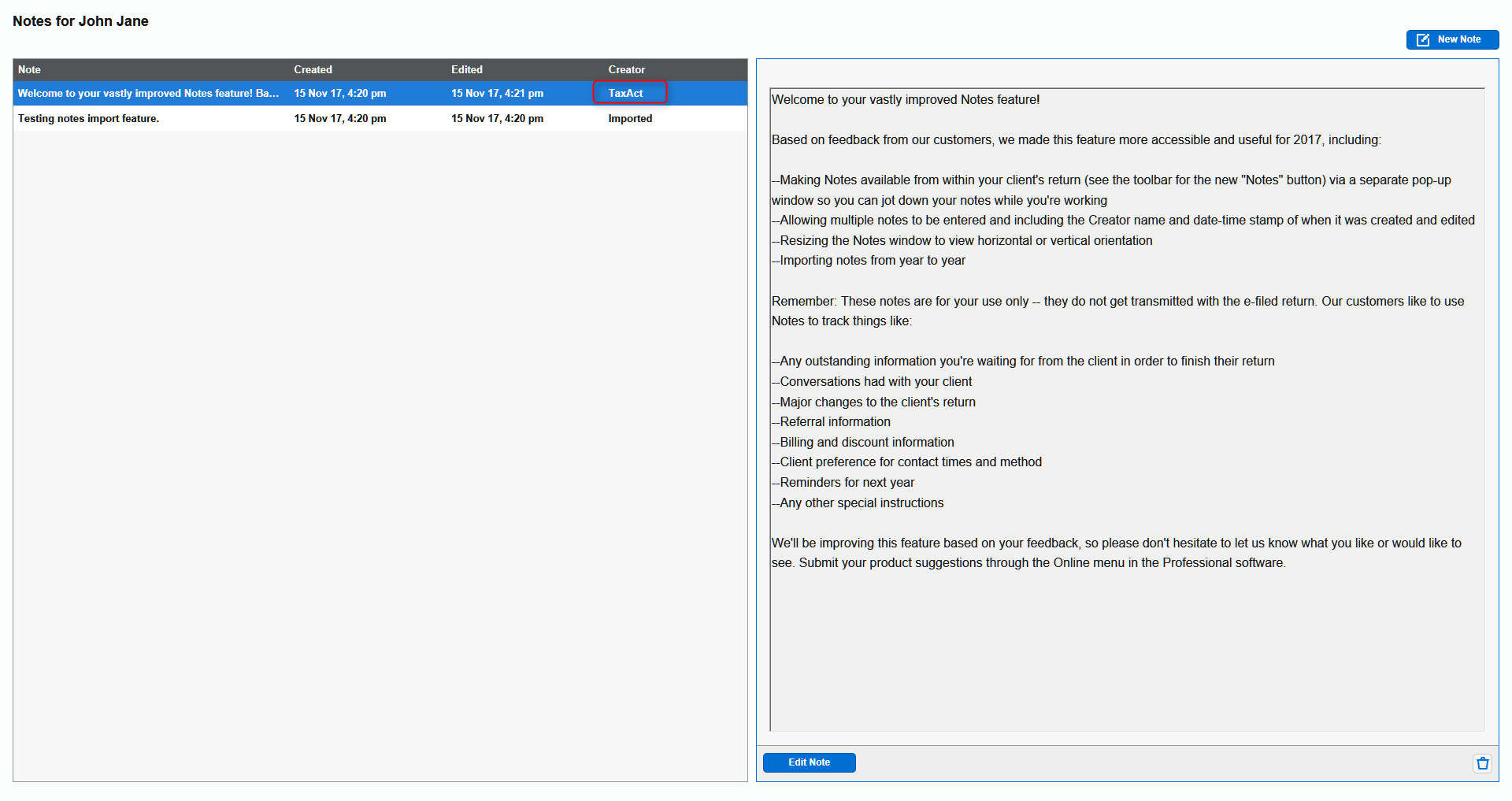

- Enhanced notes feature now accessible from Client Manager and the client return (Watch short tutorial video)

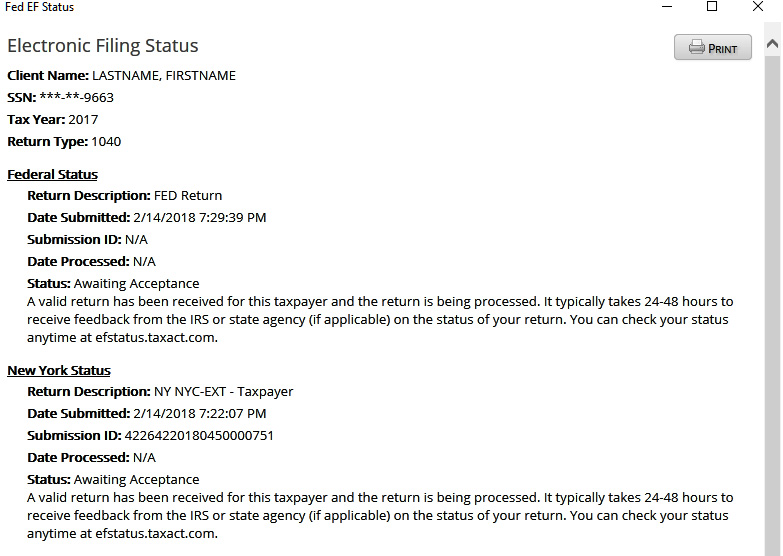

- In Client Manager, click on a link in the “Fed EF Status” column to see high level details of that return. You also have the option to print that pop-up info.

Stay tuned for more info on product enhancements!