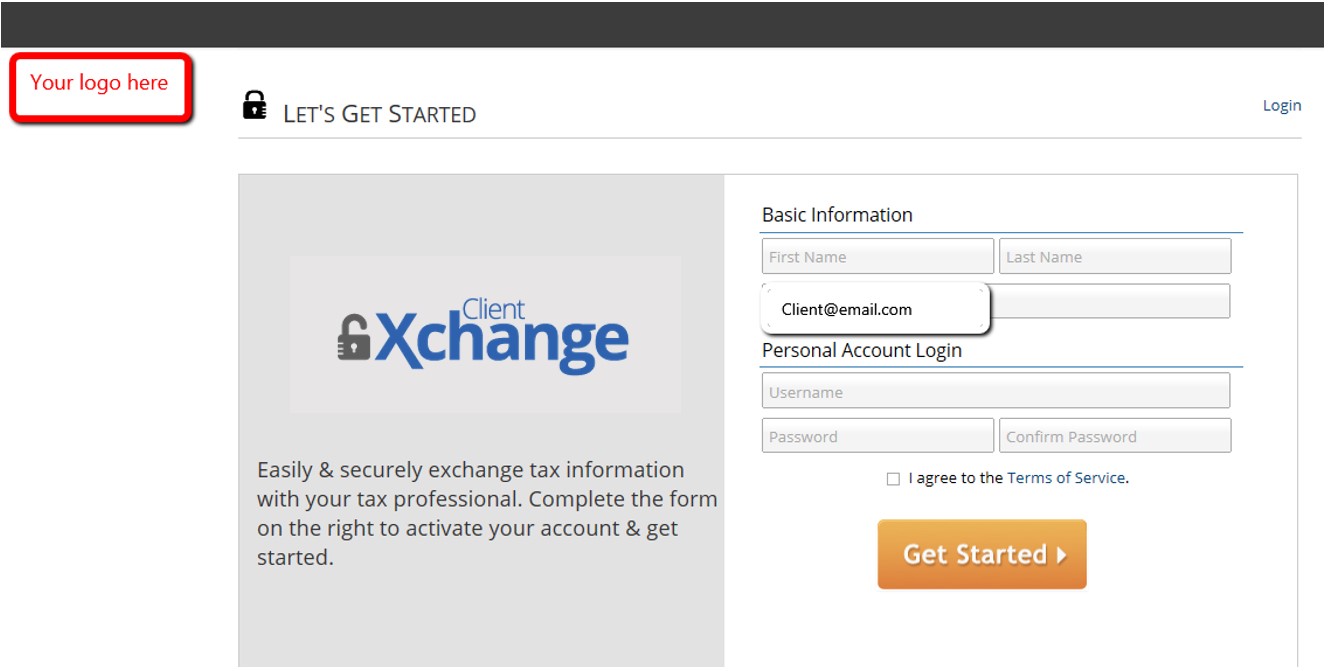

A faster, more convenient, and secure way to exchange documents with your clients.In the digital age, being able to exchange information securely, conveniently, and quickly with your clients is important. TaxAct® Professional Client Xchange enables you and your clients to do so from any device with internet access!

Easily upload and download all the tax information you and your clients need to share in seconds — from photos of Form W-2s and receipts to CSV files of stock transactions and PDFs of client organizers and final tax returns. Set up your website, give access to additional users you select, then email invitations to clients. After clients activate their secure accounts, you can start exchanging information immediately!

$99.00 for tax year 2021

- Unlimited preparers, unlimited clients

- Unlimited storage

- Custom URL (if you want to add to your website)

- Just about any file type, including documents, spreadsheets, photos, and PDFs

- Option to brand with your practice name and logo

- 24/7 access so you and your clients can securely upload and download files anytime, anywhere

- Email notification to receiving party when a file is uploaded

- Easily add and edit folders and files

- Access through October 31, 2022

To purchase

If you’re a single-preparer office, sign in to your account and click on the Client Xchange tile to purchase. Otherwise, talk to your practice owner today about purchasing Client Xchange. (In order for all preparers in a practice to have access to Client Xchange, it must be purchased by your practice owner.)

User Guide

Learn how to help set up your secure Client Xchange web portal, invite clients and manage files. Includes easy instructions you can provide to your clients. Download User Guide

Need something more robust?

TaxAct, Inc. gets fees from some third parties that provide offers to its customers. This compensation may affect what and how we communicate their offers to you. TaxAct is not a party to any transactions you may choose to enter into with these third parties, and disclaims any liability arising out of such transactions.