Your PTIN expires December 31. You must renew it before submitting any returns during the upcoming tax season.

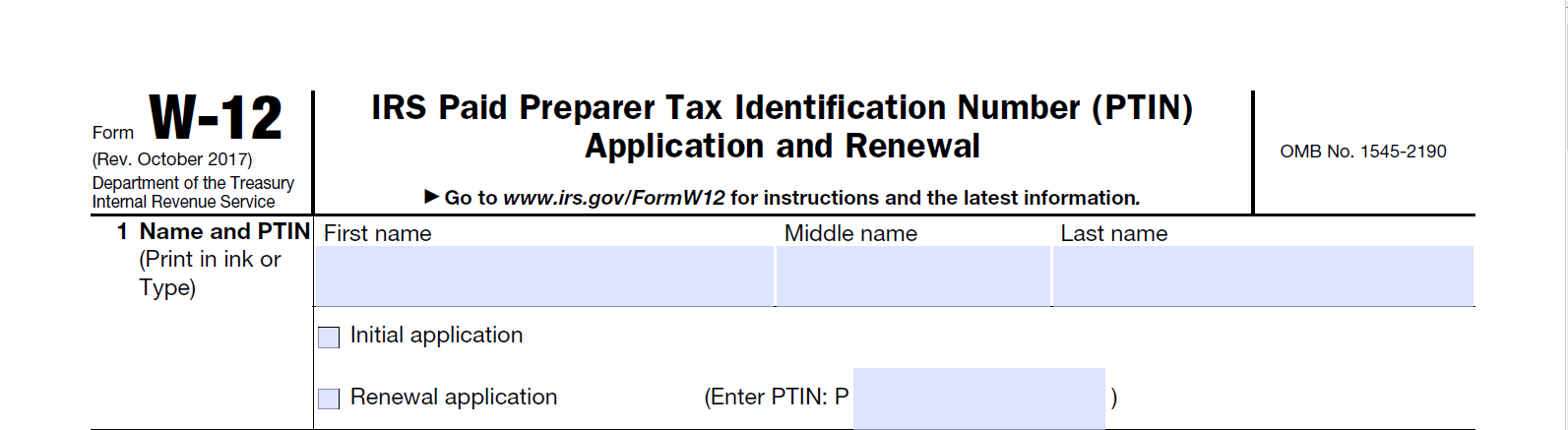

Apply for or renew your preparer tax identification number (PTIN) annually. If you prepare or assist in preparing federal returns for compensation or you are an enrolled agent, you must apply for or renew your PTIN each year before you can file any returns during the upcoming tax season. The application and renewal period began in November. The fastest way to renew is using the IRS online registration system, as receipt of your PTIN is immediate upon successful registration or renewal. If you complete and mail a paper Form W-12, response time is 4-6 weeks.

There is no need to submit your PTIN to TaxAct® Professional for verification. Uploading PTIN documents to TaxAct will slow down the EFIN approval process for other tax professionals. Here is more information on PTIN and EFIN requirements.

Should you have any questions regarding this process, don’t hesitate to contact our Technical Support Team at 319.731.2682.