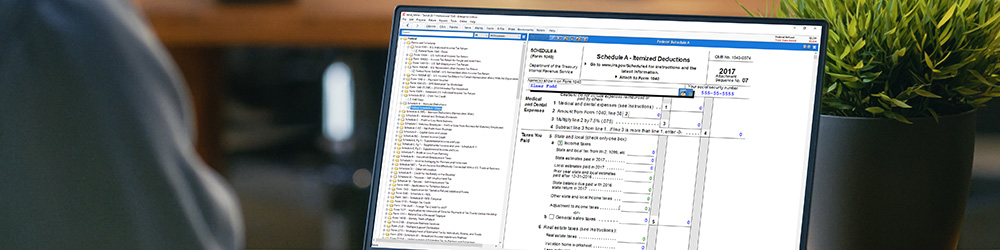

Are you prepared for the upcoming tax season? One item that might get overlooked is your computer system. Make sure your computer meets the minimum requirements for TaxAct® Professional 2018. Current system requirements are:

Operating System:

Windows® Users: Windows 7, Windows 8.1, Windows 10

Macintosh® Users: We’re sorry – TaxAct Professional Editions are not available for Macintosh

Display Resolution (in pixels):

Minimum: 1024×768 or larger

Recommended: 1920×1080 or higher

Web Browser:

Microsoft® Internet Explorer® (IE) 11

While you may not use IE 11 in your daily routine, while surfing the internet, or as your primary browser, TaxAct Professional software leverages IE for certain browser controls, so we recommend turning on auto-updates for IE 11. You can learn how to do this through Microsoft’s site.

We recommend keeping all your software, antivirus, and browsers up-to-date to ensure your system runs efficiently and your data remains secure. You will be required to change your password in TaxAct Professional each 90 days; you will not be able to reuse any of your last 4 passwords.

For locally installed users it is recommended that you back up your data to ensure the safety of your client data and business continuity, should the unthinkable happen. TaxAct Professional Editions allow you to back up your data to any external media device as needed.

If you use TaxAct Professional’s Cloud Storage option your data is already securely backed up by TaxAct. The Enterprise local storage option allows your practice to back up to the cloud as often as you like. Data storage is accessible for 7 years from the initial return year.

Remember, TaxAct Professional offers technical support for all your TaxAct Professional software needs. You can contact our Technical Support Team at 319.731.2682.

TaxAct Professional is pleased to provide our initial release for download immediately after placing your order. Simply sign into your account to download the 2018 Federal Editions and start familiarizing yourself with the new features and tax law changes.

With tax season right around the corner, make sure you’re ready.