Enable/Disable Form Descriptions?

You can enable/disable form description in the tree view >> Options section, underneath the Search bar.

Read MoreHaving issues Clearing Cache?

If you are having issues Clearing cache , See below for more details: https://www.taxact.com/support/29436/2023/clearing-the-program-cache?hideLayout=False

Read MoreGet notified when a Form/State is available

Get Notified when a form/State is available, See Below FAQ’s for more details: https://www.taxact.com/support/25002/2023/email-notification-when-forms-become-available?hideLayout=False https://www.taxact.com/support/25172/2023/state-program-updates?hideLayout=False

Read MoreImportant Bank Product Dates to Remember

Important Bank Product Dates to Remember: 1/15 – Santa Barbara TPG Software Purchase Assistance (SPA) enrollment closed. 1/26 – Republic Bank Software Purchase Assistance (SPA) enrollment closes. 1/31 – Last day to enroll in the Refund Transfer Incentive Program. May (exact date is TBD) – TY23 enrollment closes for Republic Bank. 5/31 – Refund Transfer […]

Read MoreBasics and Beyond of Crypto Taxation: What Preparers Need to Know

Basics and Beyond of Crypto Taxation: On-Demand Webinar Crucial Knowledge Tax Preparers Need to Know Cryptocurrency, or virtual currency, is a digital representation of value currently used both as a medium of exchange and as an investment. The IRS considers virtual currency to be property; in many cases, basic property tax law works well for […]

Read More

Scheduled Downtime for Software Maintenance

As part of our commitment to providing you with the best possible service, we want to inform you about an upcoming scheduled downtime for essential maintenance for TaxAct Professional. Downtime Schedule: Date: Jan 16, 2023 Time: 4:30AM – 5:30AM CST Access to TaxAct Professional will be temporarily unavailable during the maintenance. We are implementing crucial […]

Read MoreTY23 – ProConnect PDF Import – Update

ProConnect PDF Import is now working as expected. Thank you, The TaxAct Professional Team

Read MoreTY23 – ProConnect PDF Import

ProConnect PDF Import is currently experiencing issues with importing a few fields from Basic Information. Our team is working to resolve this as quickly as possible, stay tuned for an update for when this is resolved. Thank you, The TaxAct Professional Team

Read More1099-B, TAEF Recording

1099-B: Reporting Income from Securities and Bonds Recording from virtual event hosted in December of 2023. On December 7th, we hosted a 2-hour virtual event live from Savannah, GA, where Amy M. Wall presented on 1099-B. A special thanks to everyone that joined us live! Because 1099-B: Reporting Income from Securities and Bonds is such […]

Read More

Stop Chasing Paper, Start Offering eSignature – Webinar Recording

Stop Chasing Paper – Start Offering eSignature Recording from webinar hosted by TaxAct Professional and DocuSign®. On December 14th, TaxAct Professional partnered with DocuSign® to host a brief 1-hour virtual event on eSignature. A special thanks to everyone that joined us live! Because we continue to grow and improve our integrated eSignature tool, we felt it […]

Read More

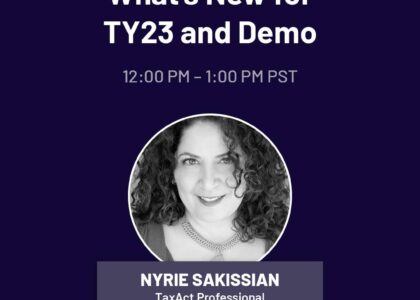

What’s New for TY23 – TAEF Recording

What’s New for TY23 and Demo Recording from virtual event hosted in August of 2023. On August 17th, we held a 2-hour virtual event, live from Los Angeles, CA, where industry experts came together to help tax professionals prepare for the upcoming tax season. A special thanks to everyone that joined us live! Because this […]

Read More

FREE Downloadable Tax Calendar

FREE Downloadable Tax Calendar May 2023 – April 2024 We know that being a tax preparer is incredibly stressful and busy, to say the least. To help you save time and energy when it comes to remembering dates and deadlines, TaxAct Professional has put together a calendar for you to download (for free) and immediately […]

Read More

Basics and Beyond of Crypto Taxation: What Preparers Need to Know

Crypto Taxation Basics and Beyond: What Preparers Need to Know Crucial Knowledge for Tax Preparers Going Into TY22 Cryptocurrency, or virtual currency, is a digital representation of value currently used both as a medium of exchange and as an investment. The IRS considers virtual currency to be property; in many cases, basic property tax law […]

Read More

Important Information for Next Tax Season!

Important Information for Next Tax Season! Tax Changes and gearing up for TY22, written by Nyrie Sarkissian, a fellow Tax Professional. Gearing Up for TY22 By: Nyrie Sarkissian TY22 is coming. That means it is almost our time to shine! But are you prepared to do your best? Many people ask me how I prepare […]

Read More