When Your Client Files Taxes Will Affect Their Stimulus Payment. Here’s How.

Turns Out, it is Not A Normal Year In a normal year, it’s a good idea to nudge your clients to file their taxes early. It helps to reduce fraud risk, gets your clients a refund sooner, and eliminates the frantic rush mid-April. This year things are a little different. Depending on when your client […]

Read More

Do more for your clients with tax-smart financial planning and wealth management.

The Financial Services Firm of Tax Professionals You may know our parent company Blucora offers a range of tools to help master the tax landscape. You may not know that they also offer a tax-smart approach to financial advising. They do this through services provided by our sister brand Avantax SM. The Avantax Advantage Avantax […]

Read More

Paycheck Protection Program and 2020 Taxes

One of the biggest initiatives to support businesses through the COVID-19 pandemic is the Paycheck Protection Program (PPP). The PPP was designed to help businesses keep staff on payroll by providing a loan to fund payroll costs as well as limited other business expenses. While a loan is helpful during these uncertain times, one of […]

Read More

Know Someone Wanting to Start a Tax Practice

You might have had a recent conversation with someone who is interested in starting their own tax practice. This e-book is a great resource to share with them as they consider how to move forward. It’s not as simple as hanging an open sign in your office window. In this e-book we offer tax professionals […]

Read More

How To Deal with Conflict Well in your Tax Practice

Listen as John Bower explains how to deal with conflict in a way that benefits you and the other party involved. As John points out, emotions buried alive never die. This is a powerful video that will help guide your interactions with your clients. Video: Dealing with Conflict

Read MoreHave You Considered a .CPA Domain

.CPA is a new, secure domain exclusively available to licensed CPAs starting January 15, 2021. Having a .CPA domain will help you secure your data, enhance client trust, and strengthen your brand. To apply or learn more, visit https://register.domains.cpa/ today. Brought to you by the AICPA and CPA.com The AICPA is the world’s largest member […]

Read More

Pay Later, Get Your Software Now

ERO Select Program If you’re not ready to pay out of pocket for your tax software, good news: you don’t have to. We’re teaming up with Republic Bank for our ERO Select program. With ERO Select you’ll receive TaxAct Professional software now and then just pay $15 per e-filed TIN. There’s a minimum requirement of […]

Read More

Renew Your PTIN Now

It’s that time of year again! The New Year’s ball is about to drop and that means it’s time to renew your PTIN. All PTIN’s will expire December 31, 2020. Who needs a PTIN? According to the IRS, anyone who “prepares or assists in preparing federal tax returns for compensation” needs to have a valid […]

Read More

Essential Virtual Tools for Your Practice

If there’s anything this year has taught us it’s that being able to work from anywhere at a moment’s notice is vital. But many tax professionals were caught off guard by the different demands of a remote environment. It’s not enough to just set up your laptop in a home office and expect that your […]

Read More

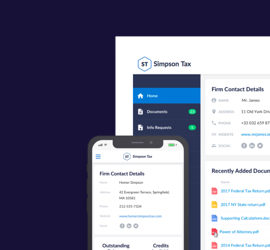

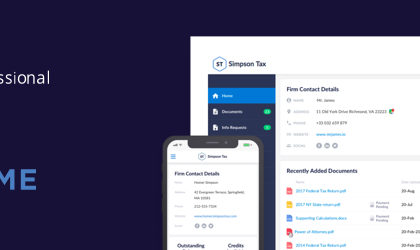

TaxAct Professional and TaxDome Partnership

CEDAR RAPIDS, Iowa, Jan. 20, 2021 (GLOBE NEWSWIRE) — 2020 made one thing extremely clear to tax professionals: the ability to manage their practices online is now an operational and competitive necessity. Thanks to a new partnership between TaxAct® and TaxDome®, tax professionals are now able to modernize their practices with everything they need to run […]

Read More

Highlighting The Importance of Cyber Security (Sponsored Content)

October is Cyber Security Awareness Month Throughout this entire year most major headlines have revolved around COVID-19, but have you thought about how COVID-19 is impacting cyber security? With many companies going remote, as well as consumers spending significant time online, cyber criminals are taking advantage. Cyber Security on the Rise According to Fintech News, […]

Read More

The IRS is Sending Tax Refund Interest Payments

If your clients contact you about a mysterious bank deposit from the IRS, you can assure them it’s not a mistake. The IRS reported that 13.9 million taxpayers who filed their 2019 income taxes on time and received a refund will now be receiving a second payment from the IRS: an interest payment. This interest […]

Read More

How to Start Your Tax Practice

Are you ready to start your tax practice? It’s not as simple as hanging an open sign in your office window. In this article we offer you tips to walk you through forming your business, building your practice and growing it with marketing strategies. Business formation First things first, let’s get your business started with […]

Read More

How to Network and Gain Referrals During COVID-19

COVID-19 is changing the way business is done and people have found ways to adapt. Home offices and virtual meetings are now the norm. But there’s another aspect of business that needs to evolve: networking. In-person meetings are few and far between. Large events and conferences have been put on hold. Rather than seeing this […]

Read More

PTIN User Fees Reinstated for 2021

Preparing taxes in 2021? Be prepared to pay. The Preparer Tax Identification Number (PTIN) fee is back. While the PTIN fee has been reinstated, it’s lower than it previously was. The IRS announced that the 2021 PTIN fee will be $21 plus $14.95 payable to a third-party contractor. The fee has decreased from $33 plus […]

Read More