*UPDATE (4/17/18 at 6:30pm central)*

The Internal Revenue Service announced today that it is providing taxpayers an additional day to file and pay their taxes following system issues that surfaced early on the April 17 tax deadline. Individuals and businesses with a filing or payment due date of April 17 will now have until midnight on Wednesday, April 18. Taxpayers do not need to do anything to receive this extra time.

*UPDATE (4/17/18 at 4:23pm central)*

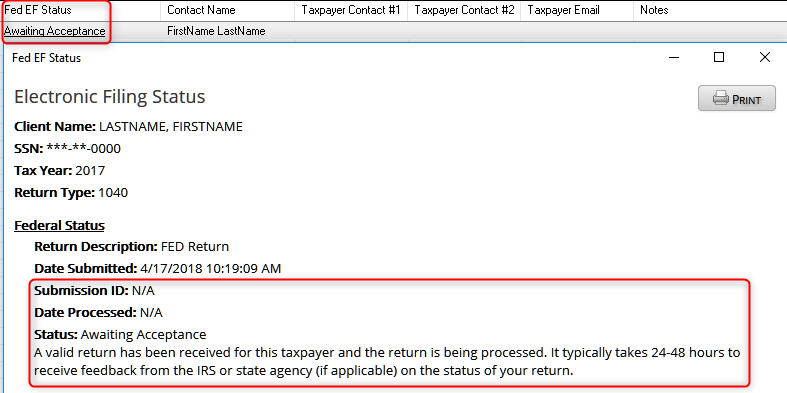

On April 17, 2018, the IRS Modernized e-file system went down and was unable to process income tax returns until late afternoon. The IRS has confirmed they are now able to resume normal processing. Please be aware that there still may be a delay in seeing acceptance emails as they process a high volume of returns for the deadline today. Submitted returns will have a Federal EF Status of “Awaiting Acceptance” until processed by the IRS.

Any returns submitted by 11:59 p.m. today will be considered timely filed even if you don’t have an acceptance status by the deadline. If a return filed today is rejected, you will have 5 days (through Sunday, April 22) for Individual income tax returns and 10 days (through Friday, April 27) for Corporate or Trust & Estate returns to correct and resubmit the return electronically or mail a paper return and still be considered timely filed.

*ORIGINAL POST (4/17/18 at 11:00am central)*

The IRS Modernized e-file system is currently down and unable to process income tax returns. Please continue to file client returns and we’ll submit them as soon as the IRS system is back up. Submitted returns will have a Federal EF Status of “Awaiting Acceptance” until processed by the IRS. Once the IRS is back up, it will still take some time for them to process the backlog of returns.

Any returns submitted by 11:59 p.m. today will be considered timely filed even if you don’t have an acceptance status by the deadline. If a return filed today is rejected, you will have 5 days (through Sunday, April 22) for Individual income tax returns and 10 days (through Friday, April 27) for Corporate or Trust & Estate returns to correct and resubmit the return electronically, or mail a paper return, and still be considered timely filed.

For those checking the Fed EF Status column for updates, this is what you will see until the IRS has processed your client’s return:

For those checking the Professional Reports for updates, this is what you will see until the IRS has processed your client’s return: